The Washed Silica Sand Market to Emerge as the Fastest Growing Segment Owing to Rising Demand from Construction and Industrial Sectors

|

| Washed Silica Sand Market |

The washed silica sand market is a type of industrial sand with low clay and silt content used for applications requiring high purity. It is produced by screening and washing of natural sand deposits to remove fine particles and impurities. The washed silica sand has a purity of over 99% silica content making it suitable for various construction and industrial applications. It finds use in glass making, hydraulic fracturing, water filtration, metal casting, etc due to its high purity, smooth texture and round particle shape. The rising demand from construction sector for manufacturing concrete and asphalt is driving the market.

The global washed silica sand market is estimated to be valued at US$ 18.56 Bn

in 2024 and is expected to exhibit a CAGR of 5.6% over the forecast period 2024

to 2031.

The

construction industry remains the major end-user of Washed

silica sand Market size accounting

for over 30% of global demand. It is used in the manufacture of concrete and

asphalt owing to its ability to enhance strength and durability of the final

product. Further, growing oil & gas exploration and production activities

are spurring demand for hydraulic fracturing requiring huge volumes of premium

washed sand.

Key Takeaways

Key players operating in the washed silica sand market are Unimin Corporation,

Fairmount Minerals, US Silica Holdings, Inc., Emerge Energy Services LP, Badger

Mining Corp, Hi-Crush Partners, Preferred Sands, Premier Silica, Pattison Sand,

Sibelco, Minerali Industriali, Quarzwerke Group, Aggregate Industries &

WOLFF & MÜLLER, VRX Silica Limited, Australian Silica Quartz Group

Ltd, Adwan Chemical Industries Company, Refcast Corporation, Zillion Sawa Minerals

Pvt. Ltd., TMM India, and Srinath Enterprises.

The construction industry remains the key end-user segment and is expected to

drive over 30% of demand for washed silica sand. Rapid urbanization and

infrastructure development plans across developing countries are fueling

consumption.

Technological advancements in mining and processing techniques such as advanced

screening and washing systems have improved the productivity and purity of

washed silica sand. This is encouraging capacity additions to cater to growing

demand.

Market Trends

Growing demand for glass from packaging and automotive industries - Rapid

growth of the packaging industry due to e-commerce boom and rising vehicle

production are propelling glass demand. This will amplify washed silica sand

consumption in glassmaking.

Increasing focus on R&D of synthetic aggregates - Ongoing R&D to

develop synthetic aggregates from fly ash, slag, etc. that can replace washed

silica sand in some applications is a budding trend in the industry.

Market Opportunities

Untapped potential in Asia Pacific - Countries like India and ASEAN nations

offer immense opportunity for market players owing to improving economic

conditions and massive infrastructure spending.

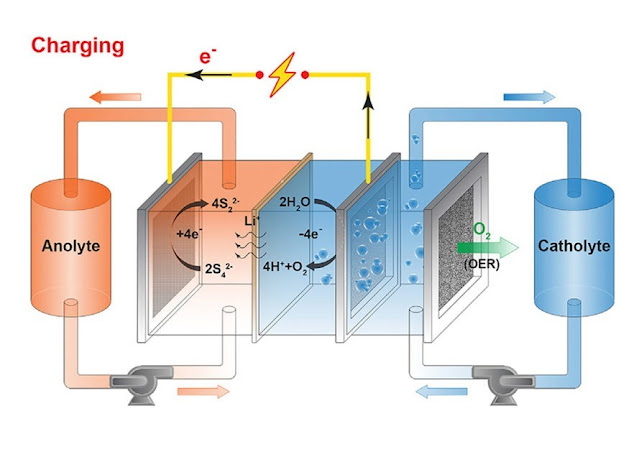

Emerging applications in lithium-ion batteries - Washed silica is finding new

application as a key component in the production of silicon-based lithium-ion

batteries providing longer charge and life.

Impact of COVID-19 on Washed Silica Sand Market

The COVID-19 pandemic had a notable impact on the washed silica sand market.

During the initial outbreak and lockdowns in early 2020, supply chains and

logistics were severely disrupted. Construction projects faced delays or

shutdowns due to restrictions on workforce movement and availability of raw

materials. This led to a steep decline in demand for washed silica sand from

key end-use industries like glass, paints & coatings, plastics etc through

2020. Fluctuating demand and supply imbalance impacted prices in the short

term.

However, with relaxing lockdowns and resumption of activities from mid-2020,

the market saw a gradual recovery. Governments announced infrastructure

spending programs to boost economic revival which increased demand. Recovery

was faster in the construction and automotive glass segments. At the same time,

higher hygiene standards increased usage of washed silica in sanitaryware and

personal care products. The electronics industry also performed well driving

photovoltaic glass requirements. Overall, the market is estimated to have

declined by around 5-7% in 2020 but returned to growth trajectory from 2021

onwards.

Going forward, continued infrastructure expansion, real estate growth and

rising standards of living are expected to support market growth post pandemic

as well. However, volatility in raw material prices due to supply chain issues

and higher energy costs remain challenges. Sustainable mining practices and

alternative sourcing strategies need to be adopted.

Geographical Concentration of Washed Silica Sand Market

In terms of value, the washed silica sand market is highly concentrated in

North America and Asia Pacific. North America currently accounts for over 30%

global market share led by the United States. Abundant reserves, growing

construction activities especially in residential sector and thriving

automotive glass industry drive demand. Government funding for infrastructure

projects especially for road and rail networks will further aid growth.

The Asia Pacific region including China and India is the fastest growing market

for washed silica sand globally growing at over 8% annually. This is attributed

to rapid industrialization and rising building construction in developing

countries. Cheap labor, availability of raw materials and presence of prominent

end-use industries have made Asia Pacific an attractive production base. Going

forward, Southeast Asian countries and economic corridors under the Belt &

Road Initiative are expected to boost regional consumption.

Get

more insights on This Topic- Washed

Silica Sand Market

Comments

Post a Comment